Have you heard of the Shipathon ?

The Shipathon is nothing less than an intense parcel delivery marathon for all the logistics and e-commerce players, who are particularly busy at the end of the year, with Black Friday, Cyber Monday and Christmas of course. The colour palette for future promotional days is growing all the time, and will soon be complete: Purple Friday and Yellow Friday are already here !

This trend is particularly prevalent in the UK, with major players such as Fedex seeing a 29% increase in the volume of parcels delivered in 2020.

E-commerce has experienced exceptional growth, up 18% since 2000, with a marked increase of 32% for 2020 (source: Fevad), and this phenomenon has of course accelerated with Covid 19, with consequences and impacts for the entire industry.

But this rise in packaging prices is just one accelerator in a much more global phenomenon affecting packaging in the plastics and cellulose industries.

No country is spared, because these industries are global.

First consequence: a shortage of packaging materials.

A number of phenomena have come together :

- More or less unforeseen production shutdowns in 2020, particularly in the plastics sector

- The unexpected rise in demand from China and the USA for certain materials. These 2 countries import wood in particular.

- Sustained demand is increasing requirements across the board in all sectors, with the main sectors concerned being construction and packaging.

- Since the beginning of the year, the price of cardboard has soared due to the increase in the price of raw materials such as starch, paper and inks, as well as the price of energy, which of course has an impact on the final price.

- The coronavirus crisis alone, in 2020, led to a 35% increase in distance purchasing of items such as clothing, furniture and household appliances.

Second consequence : rising prices.

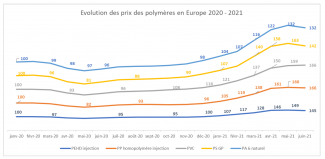

Here are a few figures to illustrate the price impact on these two main packaging-related sectors.

For plastic :

Plastics are not always fantastic, and they are criticised above all for their impact on the environment, but it is above all their excessive use and the lack of resources put in place for waste treatment that pose a problem. Plastics still have a long way to go, and the development of recycling solutions will enable them to be used in a more eco-responsible way.

An increase of between 20% and 50% has been observed, with PVC, for example, rising by 67% between July 2020 and February 2021.

Plastics obviously include Polystyrene Chips, air cushions and bubble wrap.

Recycled plastic, which accounts for only 15% of the resin used and is growing by 1 percentage point a year, is struggling to make headway.

The main obstacle to its development is not cost, but standards and administrative authorisations, making it impossible to use this plastic for food products, for example.

For cellulosic materials :

With consumption on the rise, e-commerce (which requires more packaging) continuing to grow, and packaging solutions increasingly migrating from plastic to cellulose, demand for paper and cardboard is under pressure. It would be technically possible to replace plastic with cellulose in virtually all current applications, but we would run into a serious raw materials supply problem. Some manufacturers are already talking about possible shortages…

The rise in prices can be explained by a combination of factors :

- Cellulose is the focus of many new demands linked to alternatives to plastic, while at the same time having to cover recurring needs, of which packaging is obviously one.

Recurring needs concern the building industry, energy and the paper industry in general.

2.The impact of rising transport prices is accentuating this phenomenon.

In the first quarter of 2021, freight transport and storage prices rose in all sectors. Maritime transport prices recorded the biggest increase (+16.1%), followed by air transport (+11.9%), and to a lesser extent rail (+1.7%) and road (+0.8%).

3.Massive damage to our wood reserves by bark beetles* means that millions of cubic metres of wood have to be downgraded every year.

This across-the-board increase is having a particularly strong impact :

For example, between January 2020 and October 2021, the price of wood rose from €90 to €310 per tonne (and the price of recycled material quadrupled).

The starch used to bind the fibres has increased by 50%. (Source: SmurfitKappa).

For packaging, this means an increase of between 30% and 40% for cardboard boxes, bearing in mind that e-commerce uses 7 times more corrugated cardboard boxes than traditional logistics.

The increase in recycled products is therefore highly relevant in terms of providing an alternative and offsetting this price rise.

What are the possible outcomes…

If we see the Shipathon as an indicator of a more global phenomenon and its consequences for the availability and prices of packaging-related goods, it is also interesting to see it as a stimulus for finding and strengthening alternatives to the two main channels mentioned above.

Even if, over time, this inflationary phenomenon will naturally diminish in certain areas, it will be interesting to illustrate the alternatives and solutions that will emerge as a result.

We’ll be coming back to this in a later article in January.

* For more information :

Perspective économique les approvisionnements matières (polyvia)